by Joe Vaccarella | Jun 4, 2020 | Blog, Financial, Multi-channel, Omnigage, Success Stories

By Joe Vaccarella and Indy Sarker

Customer and service provider dynamics are evolving and as a result, so must the way in which firms evaluate the customer experience. Companies are beginning to enact long-term remote working practices with the right tools in place, the customer experience can be analyzed, quantified, and improved over time to ensure workflows are always at optimal levels.

After exploring the importance of flexibility in Part 1 of our Communications and Fintech series, Part 2 will examine how to quantify the customer experience, how this can improve best practices, and how engagement analytics can help personalize and ultimately maximize every experience.

Why Numbers Matter

Quantifying customer engagement with clean data in a secure environment with a user-friendly and modern interface was the genesis of the Omnigage Platform. Omnigage’s partnership with ANALEC provides the broker-dealers and investment research service providers with an added layer of security and quality control on their client engagement activities. Numbers always tell a story. Converting interactions with clients into data-points and triggers allows far effective follow-up and greater levels of accuracy in meeting customer needs and aspirations over time. Incorporating these data-driven insights into strategies allows firms to turn intel into action and proactively address customer needs.

Through data and machine learning capabilities, a good multi-channel communications platform can suggest and create customer engagement campaigns that fit workflows and provide significant bespoke content delivery to enrich the client servicing experience. Smart analytics and consumer preferences are a key facet of Omnigage that gradually enhance its intelligence.

Quantifiable data not only creates more opportunities for the customer and service provider, but it helps foster more personalized relationships.

The Ultimate Customer Experience

Deciphering the “ultimate customer experience” can be tricky under certain circumstances, but Omnigage and ANALEC make it simple. ANALEC’s proactive management reporting and ability to tag conversations with relevant insights and inferences paired with Omnigage’s best call times and granular metrics offer a best-in-class service that fully understands the scope of any customer’s needs.

For instance, the Corporate Access process has historically been driven by in-person meetings coordinated by major banks that connect institutional investors with corporate management teams. With these events occurring in a virtual-only environment the past three months, data can illustrate which communication tools are being enacted, how long they are being used, and what facets of these tools may need to be improved so that the overall experience is more personable and efficient.

Our Bigger Picture

Customer engagement dynamics will continue to evolve as companies gravitate towards long-term remote working conditions in a post-COVID environment. Blast messaging, SMS, email, webinars, and other methods of digital communication will become integral parts of the daily workflows.

As workflows and habits evolve, so will the data. The firms that take a hard look at the details these data insights provide are those that will prosper in this increasingly remote and digital ecosystem that will undoubtedly become the new normal.

by Joe Vaccarella | Jan 30, 2020 | Blog, Communications, Financial, MiFID 2, Multi-channel, Omnigage, Thought Leadership

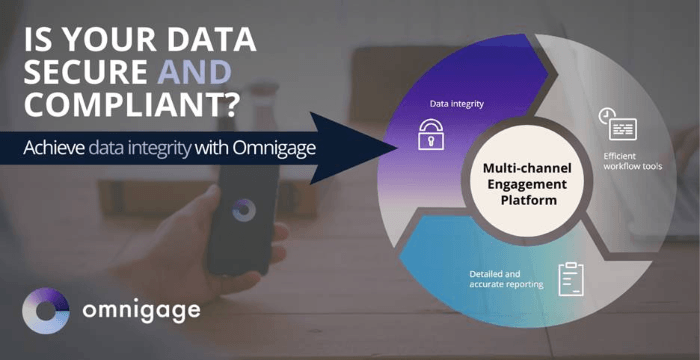

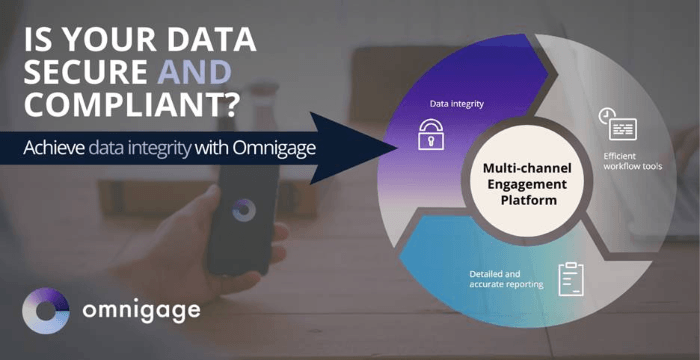

The financial industry is abounding with data, providing participants with ample opportunity to gain greater market insights and make more informed decisions. However, harnessing the oceans of data that’s available is a challenge faced by financial institutions, regulators and analysts. CIA’s Omnigage platform was designed to address this very issue.

In the first part of our series on how to enhance customer engagement practices, we examine the first of Omnigage’s three differentiators – data integrity.

Enhanced flexibility across your multi-channel engagement platform

When figuring out how to enhance technology capabilities for financial service firms, one of the first considerations must be the simplicity of the product. While flexibility and nimbleness are factors that firms desire when modernizing their fintech applications, they ultimately want something that can be easily implemented without disrupting their current workflow.

Omnigage is designed so that no additional plugins are required in order to access the platform’s suite of capabilities, whether it’s a banking analyst storing a list of contacts to issue research reports or a more advanced data set that’s applied across an organization.

With the ability to control data and content parameters across the platform and gain a holistic view of all customer information and data-driven insights, organizations are more efficiently able to identify opportunities and organize information without having to worry about data security or leakage.

Keeping up with compliance across customer communications

Compliance and regulatory initiatives – such as MiFID II, which was enacted on January 3, 2018 – have put a much greater emphasis on how data is managed and it remains a top priority for firms in 2020. With that in mind, the CIA team has a comprehensive understanding of these developments and has engineered Omnigage to ensure consistent compliance around global regulations. The platform not only allows users to review and submit data around engagements, but the process is seamless and effortless.

As the industry landscape becomes more complex and data demands more arduous, it’s important that firms do not underestimate the value of a solid client engagement platform so that the integrity of customer data is not compromised.

In Parts 2 and 3 of our series around elevating customer engagement practices, we’ll be looking at employing efficient workflow tools and the importance of detailed and accurate reporting.

by CIA Omnigage | Aug 22, 2018 | Blog, Integrated CRM Dialer

CIA Omnigage provides a one-stop-shop for all customer communication and CRM needs with their Integrated CRM Dialer.

CRM’s are a huge part of any company’s day-to-day operations. However, the process of using one can become complex and inefficient. Customers will use a calling service, and then record customer relations in a different CRM.

CIA Omnigage, however, diverges from the herd in this respect. We provide a one-stop-shop for all customer communication and CRM needs. With different features like our CIA portal for logging call information, we provide our customers with efficiency and convenience.

Using CIA as a CRM can be achieved in a few ways. One way is through our note-taking feature on the Integrated CRM Dialer. When making hundreds of calls, a client does not need to leave the page she is making calls from. She simply clicks on the contact and takes notes about the call. If the client did not answer, she can simply mark it as unanswered.

This note-taking feature of our Integrated CRM Dialer allows our customers to stay organized and keep track of their customer relationships under one platform.

To farther enhance the experience of a CRM with CIA, our Integrated CRM Dialer also saves all contact information in the CIA portal. This ensures that an analyst will not lose track of new customers. The Integrated CRM Dialer also helps improve customer relationships by allowing the analyst to easily put these contacts into groups.

These contacts will be key to an analyst and require no extra work of her. All the information stays on the same platform, and the entire process remains simple and uniform.

Finally, CIA also offers a call record log with their Integrated CRM Dialer. This allows our clients to see all calls they have made and judge their success rates. It’s a vital piece of what makes CIA Omnigage’s Integrated CRM Dialer product an effective CRM.

CIA Omnigage’s products offer to click to dial services as well as an Integrated CRM features that make the company the top choice for Wall Street banks. Our reliability and compliance have shined on Wall Street for nearly two decades. Let us show you how an Integrated CRM Dialer can improve your results.

by CIA Omnigage | Jul 18, 2018 | Blog, Integrated CRM Dialer

Time, Accuracy, Flexibility, Organization and Support

Here’s the challenge: take your huge customer database, attempt to contact large numbers of people at once, personalize the experience, and make the process efficient and cost-effective. Impossible? Not if you use an integrated dialer application. For organizations that need to contact hundreds of customers daily, this system automates the process, giving you the ability to interact with your clients in new and powerful ways. CIA offers an Integrated CRM Dialer, an integrated CRM Dialer application with key advantages. Here are the top 5 reasons why a CRM Dialer is the best way to interact with your customer base:

Time – Many companies have a call center team charged with working their way through long lists of names to contact. A CRM Dialer offers the ability to quickly and continuously contact clients, and either automatically leave a prerecorded message if the call drops to voice mail or connect the system to a live person if someone answers. The process potentially cuts down call time by a third, removes the frustration of waiting for someone to answer, and provides a delivery rate as high as 99%.

Accuracy – Accurate documentation of calls enables companies to gather data and intelligence on customer interaction. All calls are logged and processed, which makes it easy for managers to keep track of progress and employee productivity. A “Blast Report,” is generated after a call session and provides information about total time connected, success rates, and regulatory compliance.

Flexibility – A CRM Dialer is versatile and designed to integrate seamlessly with existing CRM systems or as a stand-alone, out-of-the-box solution. By contrast, the “Unified Application Environment” from Cisco, which has similar features, is limited in its ability to integrate with existing CRMs. A CRM Dialer works across industries, for firms big and small, with a user-friendly interface and simple, intuitive features.

Organization – Companies can customize different lists for unique client groups. When executing a blast, users don’t need to click on each client when the whole group is selected. Notes can be added to individual names in the database, to assist users in follow-up calls. Blasts can be launched anytime, from any location that has Internet access. A voice mail message can be delivered immediately or scheduled to be delivered at a later date. CIA even offers an app to make organizing and sending blasts simple and efficient.

Support – While a Cisco system requires dedicated hardware, a PBX phone system, and lots of maintenance, A CRM Dialer is a cloud-based system, which means lists can be created and managed, recordings can be made and calls can be launched from any location. Past recorded messages can also be archived for future use. CIA is always eager to help clients get full use out of their CRM Dialers and to assist with any questions, 24 hours a day, 7 days a week.

For more information on CIA’s Integrated CRM Dialer application, visit www.callcia.com or call (973) 439-0088.

Related Article: Find Your Lost Customers – Proactive Communication Campaigns Using a CRM Dialer